by Corbin Blackburn

Should I choose the Roth or Pre-Tax version of my 401k? That question is one I get asked at least once a month. I get asked by younger savers and high net worth executives alike. The general consensus from most clients, accountants, and other advisors I speak with is almost always in favor of pre-tax. The argument usually centers around some mixture of the points below:

- You’ll be in a lower tax bracket in retirement, so you want the deduction today.

- We don’t know what taxes will be 20 years from now, so may as well take the deduction today.

- Getting a tax deduction today allows you to save more money each year.

Now, I don’t disagree with any of those points in their entirety. I also am a firm believer that pre-tax savings should be a noticeable part of most savers’ plans, especially if the saver is in a higher (32%+) tax bracket today. That said, I do think that if most people looked at the bigger picture and examined those arguments in more detail, they’d realize that they may be underutilizing Roth accounts in their planning. In today’s blog post, I want to make the argument that most people’s tax rates won’t be as low as originally thought in retirement, meaning a Roth savings vehicle could provide them with more long-term savings.

Reasons Tax Rates May Not Be Lower in Retirement

Reason 1 – Historical Tax Rates

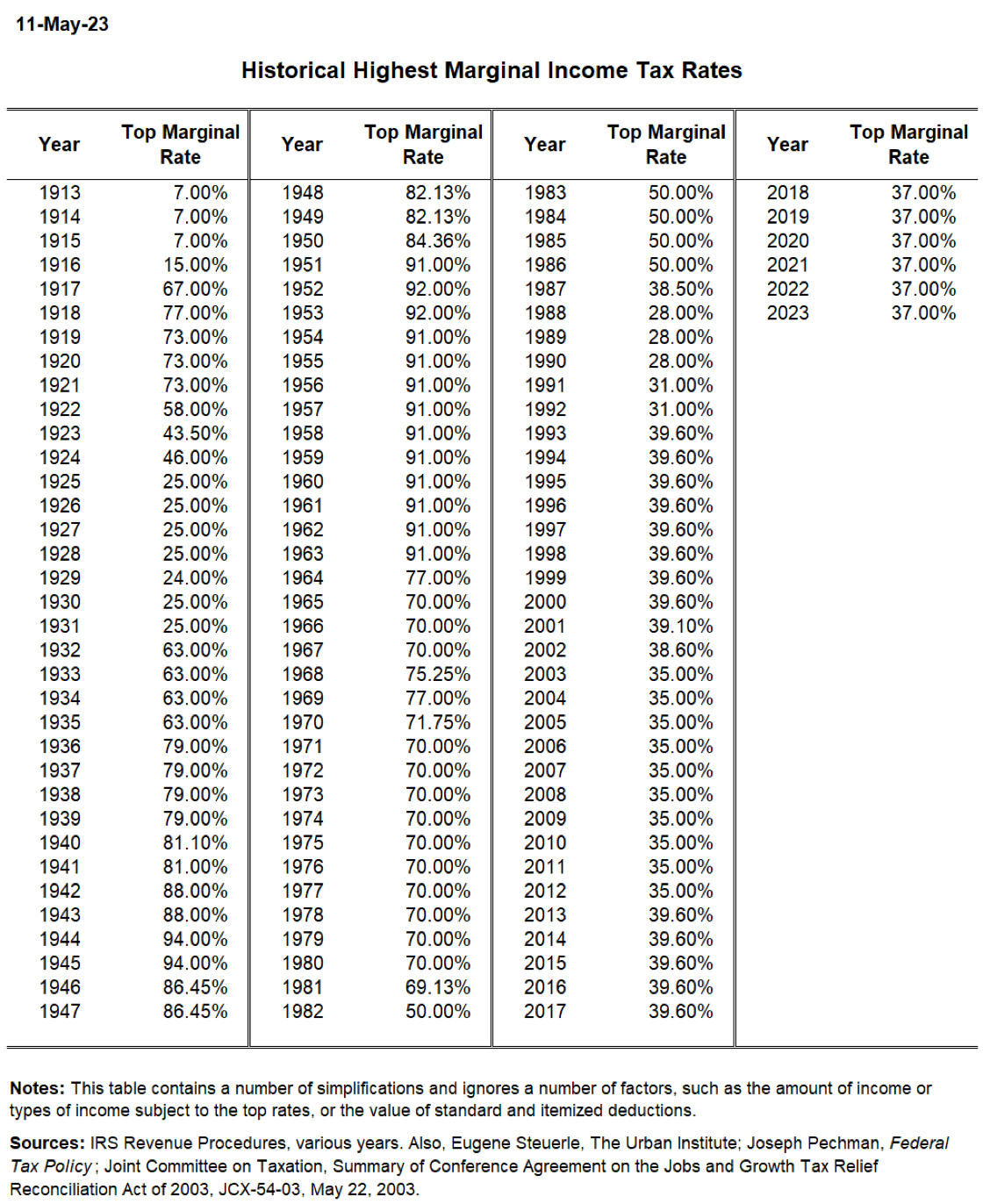

The biggest advocates for aggressive pre-tax savings argue that client’s tax brackets are going to be substantially lower in retirement. However, when you look at the chart below from taxpolicycenter.org, you’ll realize that the top marginal tax brackets today are relatively low compared to where they’ve been throughout history. It’s not unusual to see tax reform move these numbers over time, but with the growing size of our national debt it’s hard to imagine the top income tax brackets shifting down over the next 10-30 years. If you’re in a 37% bracket today, saving money pre-tax to avoid that tax so you can pay 24% later in retirement sounds great on paper. However, if tax brackets jump in retirement and you end up paying 37% or more, you ended up not saving any tax on that contribution and ultimately will end up paying additional taxes on the growth. A Roth option can be a great way to hedge against that rise in tax brackets.

Reason 2 – Required Minimum Distributions (RMDs)

Aside from the tax differences, another major difference between pre-tax accounts and Roth accounts is the Required Minimum Distributions clients have to take from their pre-tax accounts in retirement. With the great market performance we’ve seen over the last decade, I regularly meet clients that are now required to take more money in RMDs than they need, sometimes pushing them into a new tax bracket. When this happens, the whole concept of “Income Shifting” can be minimized or even eliminated because of the substantial income tax problems RMDs create in retirement. Increasing Roth assets provides you a bit more control on your taxation throughout retirement.

Reason 3 – Is your income actually going to be substantially lower in retirement?

“Income Shifting” using 401k dollars makes sense on paper, but what I’ve seen in practice is that most clients aren’t taking home substantially less income in retirement. If they were used to making $300k during their working years, they’re often around 70-85% of that in retirement. This puts them in a pretty similar tax bracket compared to their working years if 100% of that income is Social Security and pre-tax retirement accounts.

What are my options?

For clients that are looking at protecting against some of these issues by using more Roth dollars, there are a number of ways to do it.

- Direct Roth Contributions (If income qualifies)

- Back Door Roth Contributions

- Mega Roth or Spillover Roth Contributions

- Roth conversions during low taxation years

I still believe that pre-tax savings should be a major part of the plan due the three reasons mentioned at the beginning of the article, but doing so at the expense or Roth options could provide additional tax issues down the road. Incorporating both sources makes sense for most people, and reviewing that balance as income, career plans, and tax environments change can provide you better long-term tax outcomes than simply following the same rule of thumb advice most savers do.

All examples discussed in this post are hypothetical in nature and are for illustrative purposes. It is not intended to be applicable advice, as everyone’s situation may be different. Cleveland Wealth and its advisors are not CPAs. Please consult your CPA before considering any actions.

Cleveland Wealth, LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.