Weekly Market Update | July 22, 2024

The Week on Wall Street

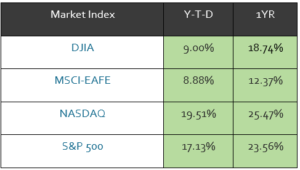

Stocks were under pressure last week as investors appeared to rotate out of mega-cap tech stocks and into areas that may benefit from lower interest rates.

The Standard & Poor’s 500 Index fell 1.97 percent, while Nasdaq Composite Index declined 3.65 percent. The Dow Jones Industrial Average bucked the downward trend, up 0.72 percent. The MSCI EAFE Index, which tracks developed overseas stock markets, slid 1.48 percent for the week through Thursday’s close.

Dow Leads Again

The week began very differently than it ended.

All three averages rallied over the first couple of days this week, with the Dow leading on both days. Fed Chair Powell indicated the Fed may not wait for inflation to reach its 2 percent target before considering a rate move, buoying the markets.

Then, markets hit a speed bump as investors appeared to take profits and rotated away from mega-cap tech names. The selling broadened beyond tech-related names on Thursday as all but one of the S&P 500’s 11 sectors fell.

Early Friday morning, a global tech outage caused disruptions for businesses, governments, and financial institutions, contributing to the weekly decline. Despite its losses in the second part of the week, the Dow finished in the green.

Upbeat Economic Data

Although stocks were under pressure, some investors saw “green shoots” in a few economic reports. Housing starts rose 3 percent in June. Building permits also ticked higher during the month. Retail sales were unchanged in June, which was better than expected. Investors were encouraged that consumers were still spending despite ongoing inflation.

Key Economic Data

Tuesday: Existing Home Sales.

Wednesday: New Home Sales. Survey of Business Uncertainty.

Thursday: Gross Domestic Product (GDP). Durable Goods. International Trade in Goods. Jobless Claims.

Friday: Personal Income and Outlays. Consumer Sentiment.

Source: Econoday

Companies Reporting Earnings

Monday: Verizon Communications Inc. (VZ)

Tuesday: Alphabet Inc. (GOOG, GOOGL), Tesla, Inc. (TSLA), Visa Inc. (V), The Coca-Cola Company (KO), Texas Instruments Incorporated (TXN), GE Aerospace (GE), Philip Morris International Inc. (PM), United Parcel Service, Inc. (UPS)

Wednesday: International Business Machines Corporation (IBM), AT&T Inc. (T)

Thursday: AbbVie Inc. (ABBV), Union Pacific Corporation (UNP), Honeywell International Inc. (HON)

Source:Zacks.com

Quote of the Week

“We are what we repeatedly do. Excellence, then, is not an act, but a habit.”

– Aristotle

Sources: YCharts.com, July 20, 2024

Weekly performance is measured from the close of trading Monday July 15, to Friday, July 19, close.

Tips For Eating Less Salt

Sodium isn’t entirely bad for our bodies, but too much can increase blood pressure and cause stress on the heart and blood vessels. Because of this, monitor your sodium intake and be aware of how much sodium is in your diet.

If you want to reduce your sodium intake, choose unprocessed or minimally processed foods. Prepared foods are generally high in added sodium compared to fresh options. Cut back on sources of high sodium, such as pepperoni pizza, white bread, processed cheese, deli meat and hot dogs, and other red meat and processed foods. Instead, eat more fruits, veggies, and whole grains, which are all lower in sodium.

Tip adapted from heart.org

Quinoa & Mango Salad With Lemony-Ginger Dressing

Servings: 4-6

Ingredients:

Quinoa and Mango Salad

- 1 cup regular, red or black quinoa, rinsed well in a strainer

- 2 cups water

- 3 mangoes

- 1 large red onion, halved stem to root and slivered

- 1 can black beans, rinsed and drained

- 2 cups micro greens (such as the rainbow blend package from Whole Foods herb section: mizuna, curly cress, red and yellow beet, arugula, cabbage) – if not available, mesclun, spring or baby greens are fine, rinsed and dried

- 3 tablespoons chopped cilantro

- 2 avocados, halved, pitted and sliced

- 1 tablespoon olive oil

- 1 pinch salt and pepper, to taste

Lemony-Ginger Dressing

- 3 teaspoons lemon juice, plus more to taste

- 3 tablespoons olive oil, plus more to taste

- 1/2 teaspoon freshly grated ginger (or 1 tsp ground ginger)

- 1 pinch salt and pepper, plus more to taste

Directions:

- Preheat oven to 400 degrees.

- Cook the quinoa: In a saucepan, bring quinoa and water to a boil. Reduce the heat to a simmer, cover, and cook until most or all of the water is absorbed, about 12-15 minutes. The little “tails” should pop free from the grain and it should still be pretty chewy. If any liquid remains, strain the quinoa. I usually add it to a strainer either way and rinse it under cold water to stop the cooking process, then continue to fluff it every so often as I’m preparing the other ingredients.

- Toss onion slivers with 1 tablespoon olive oil, salt and pepper. Roast for about 30 minutes. Resist stirring until they begin to brown, then stir occasionally; not too much or they will not brown as nicely. Remove when they are soft and nicely colored. Let cool.

- Pit and dice mangoes. Try to squeeze out some of the juices from the fibrous part surrounding the pit before discarding it – there’s often a lot of juice in that section. Add it to the diced mangoes

- Make the dressing: Whisk the olive oil into the lemon juice. Whisk in the ginger and add salt and pepper to taste.

- Assemble the salad: Mix the quinoa, mango (and juices), black beans, and cilantro together. Spread the micro greens on a large plate and layer the quinoa mixture over the greens. Top with the roasted onions and the avocado slices. Drizzle the dressing over the salad and serve.

Recipe adapted from Food 52

How to Hit a Golf Ball Lower

When you need to hit the ball lower most golfers do several things wrong. The first is positioning the ball too far back in their stance. This won’t help you hit the ball lower and might actually hit the ball higher! This is because when the ball is positioned too far back in your stance your swing gets steep. This will cause you to hit down on the ball which forces it up quickly. This also results with a ton of backspin which is exactly what you don’t want when trying to hit a low ball.

Instead, listen to the age old adage, take an extra club and swing easy. Going up one or two more clubs and swinging slightly slower (don’t think slow, think smooth) will help keep the ball low.

This method allows you to minimize the ball spin rate that would cause the call to have a higher trajectory. Lower spin rates will help keep the ball on a lower, more boring trajectory.

Beginning with your stance, make sure you have a wide enough stance so that you can have a stable base. You want a stable base because you won’t be taking a full swing and you want enough stability to promote a lower finish.

Once you are setup, choke up on the grip as this will promote a more compact swing. It will also help the ball travel through the wind with a more piercing trajectory. While you don’t want the ball off the back of your right foot, it should be back one inch from your normal position. Lastly, adjust your shoulder tilt by dropping front shoulder down slightly.

Tip adapted from theleftrough.com

Protect Your Tax Data

The Internal Revenue Service (IRS) shared guidelines that tax pros should follow to protect taxpayer data, but these principles are sound for everyone to practice.

Anti-virus software: This software scans computer files for malicious software or malware on the device. Anti-virus vendors find new issues and update malware daily. Always install the latest software updates on your computer.

Two-factor authentication: Two-factor authentication adds an extra layer of protection beyond just a password. Not only do you enter your username and password, but you also enter a security code that the service provider can send to another device for extra protection.

Drive encryption: Drive encryption transforms sensitive data into unreadable code that unauthorized people cannot decipher easily, so only the authorized person can access the data.

* This information is not intended to be a substitute for specific individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax professional.

Tip adapted from IRS.gov

Photo of the Week

Surat Thani Canal

Surat Thani, Thailand

Financial planning and investment advisory services offered through Cleveland Wealth, LLC, a Registered Investment Advisor. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified wealth advisor and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.