by Corbin J. Blackburn

Financial Planning Considerations During Residency & Fellowship

Financial planning often becomes an afterthought for a lot of physicians during their residency and fellowship programs. With a tight budget and even tighter schedule it’s easy to push it off a few more years and tackle your long-term planning when resources and time will be more available. Although there is quite a bit of logic to this decision making, it often results in opportunities and dollars being left on the table that could’ve easily been captured with a few easy discussions and decisions. In my experience, there are 5 areas where I’ve seen physicians make huge strides in their planning during residency that gave them a leg up on their peers by the time they get their first major contract. Those 5 areas are the following:

- Student Loan Repayment Strategy

- Retirement Savings Strategy

- Disability Income Protection

- Understanding Contracts & Negotiating

- Cash Flow/Financial Planning

Student Loan Repayment Strategy

After spending over a decade in higher education and training, the amount of student debt a lot of doctors accumulate can often stretch well over six figures. It also happens to be one of the largest priorities I’ve seen with a lot of my clients when they obtain their first major contract after training. But what can be done during residency?

The first step in developing a long-term plan for your loans is understanding whether they’re private or public loans. If they’re private, comparing the rates and terms to other providers in the open market could provide you with interest savings or potentially repayment flexibility. For public loans, the Public Student Loan Forgiveness program can become an option. It requires the borrower to make qualified payments for 120 months if they work for a qualifying employer. It’s a great option if you plan to work for a qualifying employer for that long, but if your future job prospects are elsewhere this program can create issues.

At the end of the day, you want to make sure you’re taking advantage of any forgiveness programs if they apply while securing the lowest borrowing rate possible. From there, piecing a long-term repayment strategy simply comes down to a matter of priorities and budget.

Retirement Savings Strategy

Although there is plenty of truth that most Doctors can play some degree of catch up for retirement once they receive their first major contract, what most don’t realize is that there are opportunities available during residency that may not be available down the road.

For starters, most residency programs offer some sort of a 401k or 403b with a matching feature. Although contributing funds to retirement may be tough to fit into cash flow, these matching dollars provide you access to money you otherwise wouldn’t have. If you’re in a training program for 2-8 years, this can certainly add up over time.

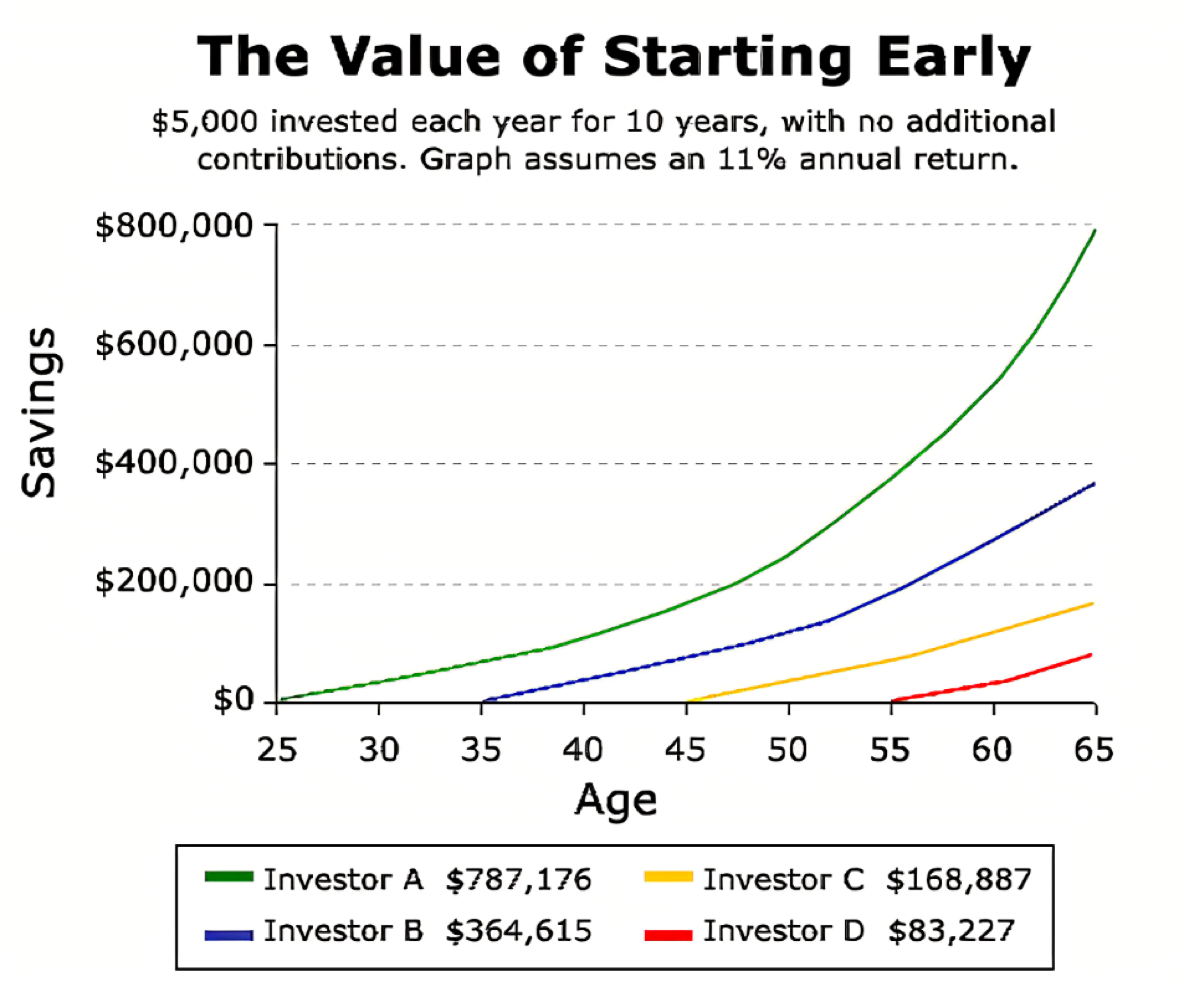

Secondly, any dollars you’re able to invest during your training are going to get an extra 5-10 years to compound. The importance of this additional compounding effect can be seen in the chart below:

Lastly, when most Doctors get their first contract, they start looking for opportunities to save money while lowering their taxes. The best way to do this is through programs like 401ks, Deferred Compensation Plans, and Pension Plans. These tools are great at that point in their career because it shifts some of their taxable income from their higher working years out until retirement when they’ll hopefully be in a lower tax bracket. As a result, they end up relying solely on taxable income sources in retirement which can cause problems if taxes ever rise. One way to get ahead of this is through various tax-free retirement accounts like Roth IRA and Roth 403bs. Tackling these during residency while your income still qualifies you can provide a nice complement to the heavy pre-tax savings you’ll use later in your career.

Disability Income Protection

After the questions on Student Loans, the most common questions I’m asked by residents are regarding the protection of their income. This makes sense, as a large portion of these individuals’ long-term financial success is reliant upon their ability to earn a high-level income for 20+ years. When it comes to protecting this earning ability as a resident, there are three areas to focus on:

- Base Coverage – Amount of money you’d receive if you become disabled today.

- Future Coverage Option – Your ability to obtain additional coverage amounts once your income increases without having to prove insurability.

- Disability Definition – Making sure that your policies pay out if you’re unable to perform your duties as a physician. Sometimes this type of coverage can also allow you to work a different job like education while you’re disabled for supplemental income.

Understanding Contracts

As your residency or fellowship comes to a close and you begin reviewing contract offers, you’ll begin to realize that the type of offers, and benefits can vary greatly. Most Doctors I’ve worked with have a solid grasp on the Base, Bonus, and Revenue Sharing compensation fits into their plan, but very few understand the true value of the various types of “Soft Dollar” compensation packages. Some of these features are below, but they can often have a major impact on your long-term financial growth. Familiarizing yourself with these terms will equip you to make an informed decision based around the total package.

- 1099 vs W2 Income

- Health Insurance Costs

- Long-Term Disability Coverage

- Life Coverage

- Professional or Personal Liability Insurance

- 403b Match and Limits

- 457 or Deferred Compensation

- Defined Benefit Pension Plans

- Loan Forgiveness Packages

Financial Planning

Lastly, having your long-term plan in place and ready to execute before you finish your residency is a huge determining factor in achieving your long-term financial success. For Doctors who understand how much money they need to save as well as where to save it before their first major contract starts, making the switch to implement those strategies is very simple. After-all, they’re often receiving 6 figure raises that they haven’t grown accustomed to, making it very easy to take a portion of that raise and allocate it according to the plan.

On the flipside, I’ve seen plenty of doctors who have waited to start planning until a few years into their first contract. In a lot of cases, these individuals have now built a lifestyle that accounts for their new income, leaving very little wiggle room to save in the various areas they need to be saving in.

Although many of the variables in this article seem small today, if implemented in a disciplined way each year they can provide a tremendous amount of value and flexibility to your future planning.

Cleveland Wealth, LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.