by Corbin Blackburn and Tim Farley, Jr.

With the consistent changes to tax code, clients are seeking any opportunity available to help shield themselves from large tax bills in retirement. One strategy that is of particular importance specifically applies to individuals who work at a publicly traded company and who own employer stock inside of their 401(k) plan.

Traditionally, most 401(k) plan balances and contributions are pre-tax in nature (meaning that when money is saved into the account there is a tax deduction on the contribution, however when money is drawn from it in retirement, any withdrawals are taxed at Ordinary Income tax rates). However, using a strategy known as Net Unrealized Appreciation (NUA) allows you to potentially lower taxes on company stock inside the 401(k) at and through retirement. Upon a triggering event such as attaining age 59.5, retirement (assuming at least age 55) or death of the participant, an individual is able to transfer the employer stock to a brokerage account and will only pay income taxes on the cost basis (your total contributions in employer stock). This must be in conjunction with rolling over any remaining 401(k) balance (via a lump sum distribution) that isn’t in employer stock to an IRA. Assuming these criteria are met, all the appreciation of the employer stock would then be taxed at a Long-Term Capital Gains tax rate as opposed to Ordinary Income when stock is sold in the future.

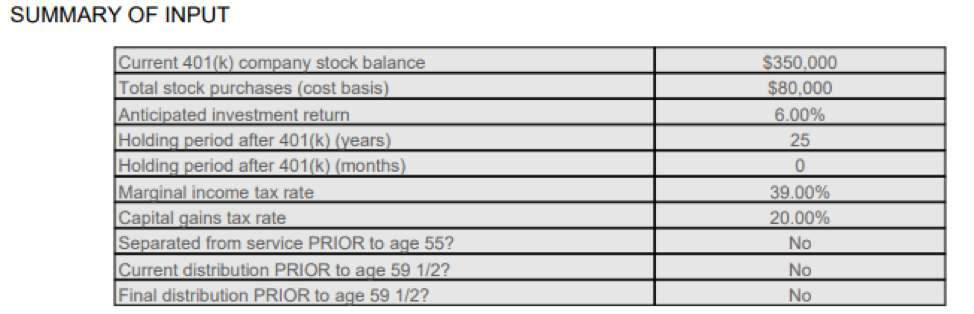

Let’s use the example above, where this individual has $350k of company stock with a cost basis of $80k. In this scenario, we assumed the top Federal tax rate, which would apply on 100% of the stock if left in the 401k or an IRA. This would be compared to the top capital gains tax rate, which is currently 20%. There may be other small additional taxes to consider depending on your state taxes or total income number, but these two rates cover the largest percentage of taxes due. We also assumed the stock would be held for another 25 years while earning an average annual rate of return of 6%.

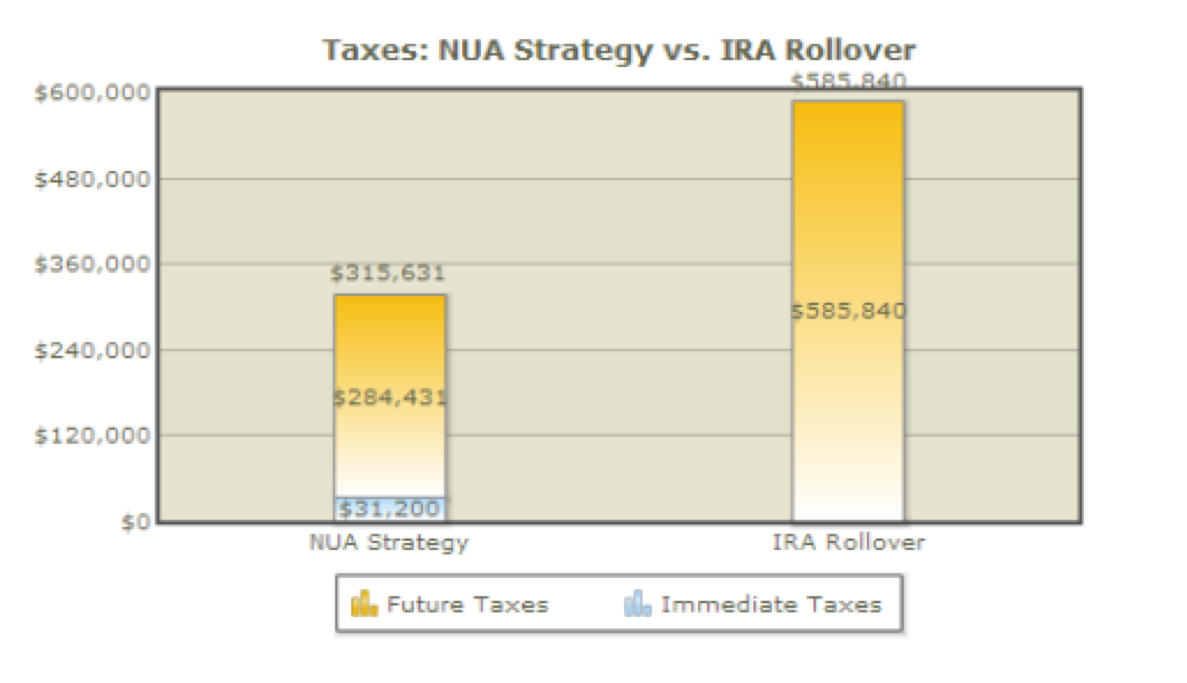

By using the NUA strategy, this individual gets hit with immediate taxes of $31,200 ($80k x 39% tax rate), whereas leaving the funds in the account results in $0 immediate tax. After that point however, the story is very different. Due to the continued growth of the stock combined with only paying capital gains tax instead of ordinary income tax, the total tax paid over life comes in at $315,631, much lower than the $585,840 that would be paid by leaving the stock in the plan.

As individuals near retirement, planning for this potential strategy requires a solid financial plan. There are several variables to consider when making the decision to utilize this option. Here are a few:

- What’s the cost basis of the stock? Usually this strategy works best when clients have a low-cost basis and large appreciation in the employer stock.

- Are you retiring at the beginning of a calendar or end of calendar year? This will impact income tax brackets.

- Are there other sources of income in the year of NUA such as Social Security, deferred compensation, pension income, dividends/interest, other IRA withdrawals, etc.?

- Where are the funds coming from to pay the tax on the cost basis in the year of NUA?

- As cash flow is laid out year by year in the financial plan, what income sources are being used when? What’s the net tax impact when adding in NUA proceeds?

Should you have questions on this strategy and wish to speak with us, please call us at 216-810-5900.

Cleveland Wealth, LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.