Can I retire? It’s probably the most asked question to financial advisors each year and it’s usually met with a generic “Well… it depends”. It’s certainly not the answer anyone was hoping to hear, but it’s very true, nonetheless. Asset levels, changing income flows, expense fluctuations, taxes, inflation assumptions, and market conditions all play a major factor in determining someone’s readiness to retire. A solid financial plan can easily help map out these various scenarios and give someone a clear blueprint of what’s possible, but that still inevitably leaves one major concern…what happens if the market collapses the year I retire?

The fear of catastrophic losses when you retire is a real fear for most, and it’s no wonder why. Today’s retirees have lived through Black Monday (Dow down 22.6% in a day), the Dot Com Crash (Nasdaq down 76.81% in 2.5 years), the Financial Crisis (S&P down 49.17% in 1.5 years), and most recently the Covid Crisis (Dow lost 37% in a little over a month). Periods like this are always stressful for investors, but when you’re in the middle of your working career you can stay invested through the crisis, potentially even making necessary rebalances or contributions along the way to bring you to the other side in a better position. Once you’re retired, you don’t have that luxury. Not only are you not investing at the bottom of the market, in some cases you’re forced to sell beaten up positions to help fund your expenses. Without a strategy, crashes like this immediately damage the financial plan and can add an incredible amount of financial stress at a time where you least want it.

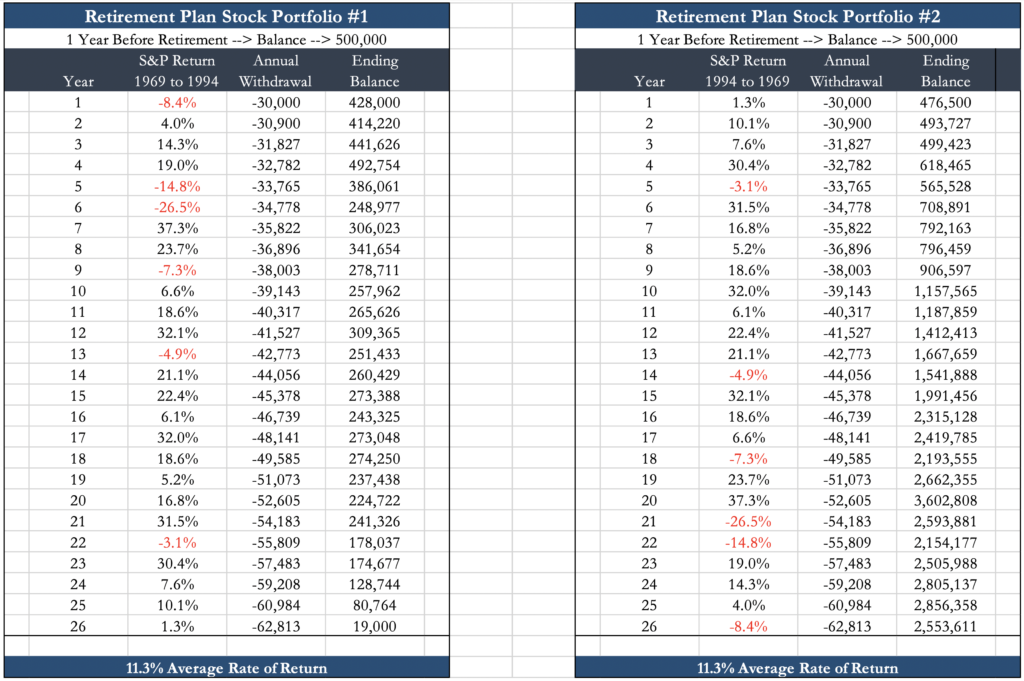

This specific market risk is known as “Sequence of Returns Risk”, and it’s most certainly a risk worth addressing when building out your financial plan. Let’s examine the two charts below.

Both portfolios assume a starting value at retirement of $500k and assume a $30k/year withdrawal for retirement expenses (Increasing each year for inflation). Both portfolios also assume an average rate of return on the investments of 11.3% over the 26-year period. Both portfolios are only withdrawing 6% ($30k) and are averaging 11.3%, so why is Scenario 2 the only one with a surplus of value at the end of 26 years? The answer has to do with Sequence of Returns.

In Scenario 1, the returns are from 1969 to 1994. These years started off with negative returns in 3 of the first 6 years, wiping out portfolio value and making it difficult for the future growth years to recover and compound quickly enough. In Scenario 2, the returns are flipped and go backwards from 1994 to 1969. The return numbers and averages are the same, but the portfolio compounds in the early years and has enough growth to withstand the negative years late. The difference in value is a whopping $2.53M!

So do you simply go extremely conservative when you retire? Or close your eyes and hope a negative return holds off for a few years? As with almost everything in financial planning, the answer lies in making sure you have the proper gameplan and strategy for when these situations arise. A proper diversified asset allocation will certainly help lower the major swings, but that’s only a step in the right direction. Setting up non-correlated buckets, pulling income from the proper sources, and timely rebalances are all additional tools that can help create the gameplan to retire confidently, despite what the market may have in store for you.

Cleveland Wealth, LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.