by Corbin Blackburn

2023 brought significant gains to the stock market. Although the backdrop for the market and economy certainly seems prettier than this time last year, investors are still asking themselves “Is it time to sell?” When you pay attention to the headlines, this is a very logical question to ask. The market just saw a huge run up, we have a presidential election approaching, interest rates are still sky high compared to two years ago, and we’re witnessing two global conflicts that don’t appear to be anywhere close to resolution. This all comes at a time where most investors’ portfolios are the largest they’ve ever been, and the thought of another 20% decline could mean several hundred thousand or several million in lost value.

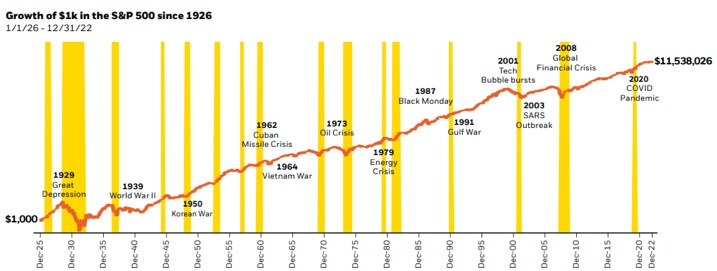

But when you take a step back, the fact of the matter is that there is always going to be a reason to sell stocks. Blackrock illustrated this point in a chart below by showing some of the major negative news stories compared to a chart of the S&P. The chart focuses on the major news events, but if you included recessions, elections, wars, and government shutdowns you’d see even more events marked. Despite all of that, markets continue to find a way to pull through over the long term.

Does this mean you only buy stocks and hold them forever? Certainly not. But focusing on the negative news headlines to make your investment decisions clearly doesn’t always lead to the best investment outcomes. Instead, our team would advocate for having a disciplined investment process tied to your long-term planning. Doing so will remove emotion from the equation and allow you to enjoy the returns investing has typically offered for the last century.

Next time the market runs up 20-30% or an external news event worries you, instead of asking yourself “Should I sell?”, ask yourself these questions instead:

- If my portfolio drops 30%, can I still meet my living expenses without having to sell a stock?

- After the recent market movement, is my portfolio overly exposed to one asset class or a sector?

- Can I emotionally stomach a 30% decline in my portfolio without selling?

- Do I have extra cash flow or conservative assets I could use to take advantage of a market pullback?

- Do I have enough time before retirement to recover if the market drops?

Answering these questions should provide some insight into how the portfolio should be managed or adjusted during times like this.

Cleveland Wealth, LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.