by Corbin Blackburn

Growing up I played a number of different sports, and one of the best pieces of advice I was given by a coach was “Don’t major in the minors”. When this advice was given to me by my basketball coach it was meant to point me in the direction of working on things like my defense, ball handling, and free throws instead of extending my three-point range to NBA length. In other words, getting back to the basics. Over the years, as I stopped playing sports and moved onto new paths in life, this advice stuck with me as something that could be applied to every area in life.

Now, as a financial planner, I see this happen constantly both with individuals managing their personal finances as well as the industry as a whole when it comes to providing advice. Everyone loves to focus on the next hot stock, the newest tax loophole, the perfectly timed trade, or whether you should own an active or a passive fund. All of these discussions certainly have their importance and shouldn’t be ignored when looking to maximize long-term success, but often times they become the focal point when the basics of planning haven’t even been addressed. This leaves much larger dollars and compounding potential on the table.

When it comes to maximizing your financial planning success, it’s important to make sure the basics are perfected and executed year in and year out. Once they are, it makes the more intricate parts of wealth management, tax planning, and estate planning that much more effective. In this blog post, I wanted to lay out some of those basics that pay huge dividends down the line.

Cash Flow

The first basic to master for planning is understanding your cash flow. Understanding what money is coming in the door, and what money is leaving it on an annual basis is the starting point for numerous financial decisions. It allows you to know how much of your money you can save or invest. It allows you to truly understand which purchases or goals fit your income. It even dictates the amount of money you’ll need one day for retirement. You don’t need to have your income and expenses mapped out on an excel spreadsheet to the penny, but failing to have a general idea of what these numbers look like can lead to poorly timed purchases, increases in credit card debt, lower than desired savings levels, and potentially goal shortages. In essence, it lays the proper foundation for all other planning.

Debt Management

Debt management doesn’t necessarily mean paying off debt as fast as possible. However, it does mean you have a strategy on how debt will be used to help you reach your goals faster. Is the debt being used to leverage a low borrowing rate, provide a tax incentive, offer future forgiveness, or additional financial perk? Or is it being used as a cash management crutch or as a way to make a purchase before your finances are truly ready for it? The former uses debt in a very strategic way that moves planning forward, while the latter uses it in a way that will slow down forward progress.

Getting/Staying Invested

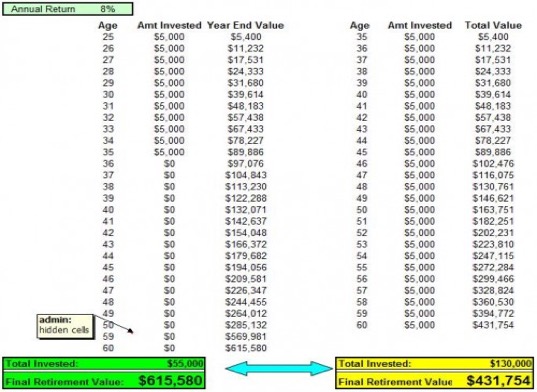

Out of all of the basics that I see missed, this is probably the most common and carries the largest financial impact. Money invested at an early age and compounded in the markets over time is the most time-tested financial planning strategy of all. Take a look at the comparison chart below and you’ll see the impact compounding can have. Waiting for the economy to calm down or for life to stabilize seems innocent and harmless enough, but oftentimes it has much more severe impacts when you compound the missed opportunities that a few years brings.

Control Your Emotions

One of the most eye-opening stats in the world of investing is the difference between the average investor return and the return of the S&P 500 over various time periods. According to a Dalbar study in 2016, the S&P 500 average return over 30 years was slightly over 10% while the average investor return over the same period was slightly below 3%. There are a number of factors that can cause this (risk tolerance, fees, etc..), but one of the largest contributors was investor behavior. In other words, investors tend to sell when times are fearful and buy when times seem great leading to a repeated cycle of buy high and sell low. This isn’t to say that you should throw caution into the wind and invest blindly, but it does point out an interesting flaw in human biases that has major implications. Understanding that bias and finding a way to control it can help narrow that performance gap.

There are certainly other bases to cover but starting here provides a solid foundation to build from. It doesn’t take a ton of work or creativity to make sure these are done, just a little proactive thought and annual discipline. Doing so will solve a lot of problems and will set up those other more complex financial strategies to be even more impactful.

Cleveland Wealth, LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.