by Corbin Blackburn, ChFC

Ask most financial planners, and the majority will tell you that the starting point of any great financial plan is understanding cash flow and cash management. This is true of both businesses as well as families planning for their future. Simply put, cash flow management is understanding what cash is coming in the door and where it is going on a weekly, monthly, or annual basis. It’s also the process of managing where the excess cash flow should be directed over time. Most people look towards their investments or tax strategies as a way to level up their finances, but often times the simplest of strategies with cash management can provide additional value to your finances that go overlooked. The 4 areas below are we recommend most clients start when it comes to analyzing their cash flow and cash management.

Wasteful Expenses

The word “Budget” often has a negative connotation for people. They associate it with cutting back, limiting enjoyable activities, and meticulously tracking expenses. As a result, it rarely gets done. In our eyes, however, budgeting is a massively important part of planning and in order for it to be effective, it doesn’t need to be painful or limiting. Effective budgeting is simply understanding your spending habits over time. When we take clients through this process, it’s very common for people to be spending money in areas where they don’t realize, and sometimes in areas where it doesn’t bring any enjoyment to the family. It’s not cutting back on the family trip to Hilton Head every year, it’s cutting out on the streaming service you no longer use or lowering the random expenses that somehow creep into every family’s budget. Although small figures when compared to the overall budget, finding these items provides you 100% return on your money since it is money being kept instead of spent. Understanding your spending habits will also help you when it comes time to establish savings strategies and eventually retire.

Cash Reserve Targets

The second area we focus on with clients is also one that we often see many individuals struggle with, and that’s setting and sticking to proper cash reserve (Checking, Savings, Money Markets) targets. Everyone’s cash reserve targets are going to be different based upon their risk tolerance, income stability, and upcoming expenses, but the truth for everyone is that you can have too much in cash reserves, just like you can have too little. The goal is to have enough cash where you can whether a short-term financial hit (job loss, disability, furnace breaks) without racking up debt, but also not to have too much where you have money sitting in a low interest account that isn’t moving you closer to your financial goals. This seems easy enough, but most people don’t have targets for the “Too much” and “Too little” amounts and they end up falling way outside what a healthy range would be. Setting those targets and staying disciplined with them will help prevent financial emergencies in hard times while getting your money to work for you during the good times.

Higher Interest Opportunities

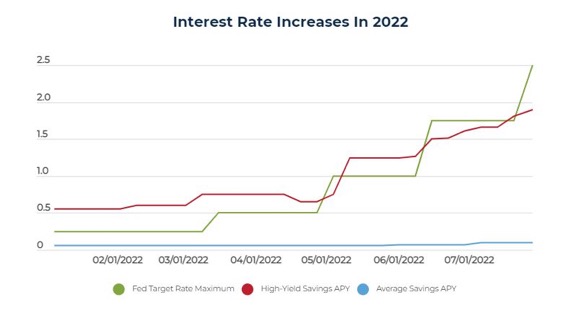

For individuals holding larger amounts of cash, analyzing where it’s being held is an important step, especially in 2023 when this is being written. Many people think all savings accounts are created equal, but with the recent rise in interest rates the spread between what competitive banks pay compared to what lower banks pay is widening fast.

For great savers with high cash balances, having a lower interest rate means you’re leaving money on the table. Looking at tools like Online Savings accounts, Money Markets, CDs, and T-Bills could provide you easier rates of return on the money you’re not allocating elsewhere.

Systematic Savings Opportunities

When it comes to getting excess cash and cash flow invested for your goals, most people just wait as their savings account builds up. Once it does, they then consider the option of getting some of it invested. Although this isn’t an awful strategy, it has two major downfalls that many people fall subject too. First, larger dollar amounts mean larger emotions. For many, this makes it difficult to put money at risk in the markets for fear of it losing in the short term. Second, the potential for short-term losses can also make the timing of your investment more important, which statistics say is very difficult to do effectively. This is where proper systematic savings can come in.

Once you understand your spending habits and have identified proper cash reserve targets, it’s very easy to identify dollars that you can save into the market. You’re then enabled to save smaller amounts each month or quarter into the market. This minimizes emotional impact and short-term market swings, while also fulfilling the ultimate goal of getting your money to work for you for the long-term.

There are a number of other cash management strategies to consider, but the 4 topics above are simple to implement and can pay huge dividends. If you need help organizing this with your personal planning, feel free to reach out to a team member and we’d be happy to assist.

Cleveland Wealth, LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.