by Corbin Blackburn

When it comes to maximizing one’s financial outcomes, many investors spend too much time focusing their energy and attention on the least important factors. They’ll focus on decisions like:

- Should I choose Stock X or Stock Y for my large cap growth?

- Should I sell now, or wait until tomorrow when the market is hopefully higher?

- How much of my portfolio should be in Large Cap vs Small Cap?

- Should I use an active fund or passive fund?

Now, these decisions are still important to maximize your financial outcomes. The problem lies in the fact that many individuals rely solely on these variables and end up missing out on the easiest fixes that can often provide the largest improvements. The easiest fix with the largest impact that we’ve seen over the years lies solely in understanding investor behavior and emotions.

A study done by Dalbar, Inc. back in 2020 provides a perfect example of this. In the study, Dalbar found that over a 20-year period the average equity fund investor underperformed the equity index (S&P 500) by 1.81%. They concluded that the reason investor returns were so low was because their emotion and personal biases were getting in the way of sound decision making.

As financial advisors, one of the greatest values we can add is helping investors avoid these emotional biases to help improve their outcomes. The first step in doing that is understanding the biases that exist, so you can develop a gameplan and strategies to deal with them. The three biases below are some of the more common we tend to see.

Acting Due to Fear or Greed

Fear and greed are far and away the most likely contributors to poor investor performance. With today’s 24/7 news cycle, this has become even more amplified. When markets or an asset class are going down, investors see negative headlines everywhere they look telling them worse is coming. Everyone knows the saying “Buy Low and Sell High”, but fear drives investors to sell low for fear lower days are coming.

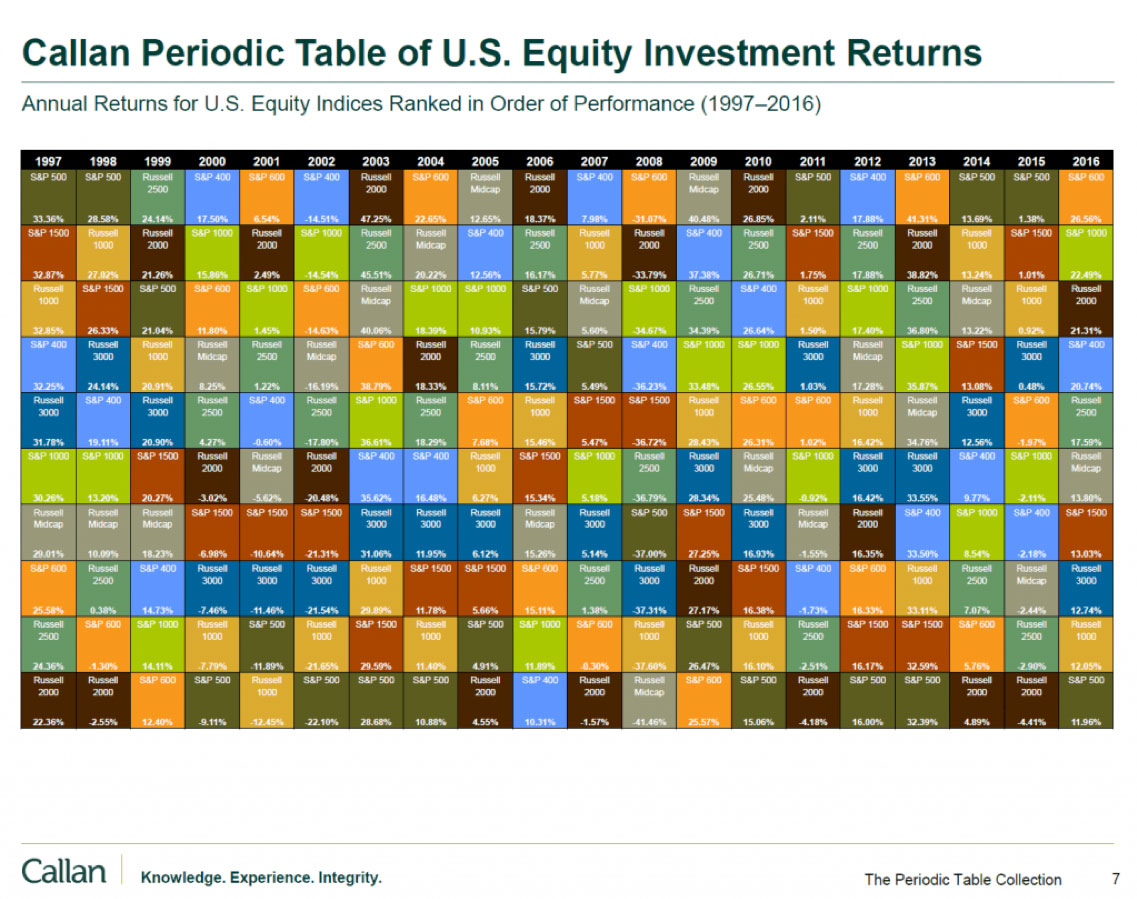

This is true on the upside as well. When an asset class is on a major run, it’s easy to feel like your other diversified positions are underperforming, leading you to sell them and move them to the asset performing well. This desire to chase returns is driven by greed and can lead to a roller coaster of performance. Take a look at the chart below from Callan Funds and follow the Russell 200 (Brown Square). Not only does performance fluctuate from year to year, but in years where it is the best it often drops down to one of the worst performers the following year. Greed is a major cause of this.

Waiting For a Better Time

This bias consistently shows itself in two ways for investors. The first is in regard to when you should get money to work in the market. It’s very common for investors to build up cash positions waiting for a better time to invest it (When markets are down). However, when markets are down the news cycle is also pretty bleak, leading these same investors to sit on that cash a while longer until the coast seems clear. By the time the coast seems clear, the market has already recovered, and they missed out on the exact opportunity they were saving cash for in the first place.

The second way these bias manifests itself is with younger savers. Many people early in their career tend to rationalize why they aren’t investing yet. “I’m going to pay off my loans first”, or “I’m going to build a house or start a family”, or “Once I start making $100k I’ll look to invest”. Although each of these excuses comes from a very rational point of view, the fact is that they’re all resulting in missed compounding that could be happening during these crucial earlier years. Getting you money to compound for an additional 5-10 years can be a much larger difference than most people think.

Familiarity Bias

This bias is very common for individuals who own stock in the company they work for. They understand the business, trust the people, and believe in the vision. This leads them to overemphasize return potential and underestimate the risk associated with a large position in that stock. It can also lead them to ignore other companies with similar outlooks that could provide similar returns with more diversified risk.

Closing

These three examples are very common, but there are numerous others that can get in the way of long-term performance. By identifying which biases are impacting your decisions, you can put a plan in place to remove emotion and improve outcomes.

Cleveland Wealth, LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.