by Bernie Garrah

Generational Wealth Creation and Transfer Requires a Team Effort

Is this just for lottery winners? Professional Athletes? CEOs of companies? The answer is no. Many individuals have worked hard, started a business, saved money over their working years, and made good investment decisions.

Wealth creates the opportunity for you to protect your independence, provide for your loved ones, establish a legacy, and live your best life. Generational Wealth refers to assets passed down from one generation to the next. These assets can include stocks, bonds, property, a family business, and other valuables.

For example, when a grandparent passes away, their $5 million dollar fortune gets divided evenly and passes to their 4 children and 5 grandchildren. The money and assets passed down would be consider generational wealth.

We assist our clients with building their wealth for them to live on and work with estate planning attorneys and accountants to ensure the assets are passed down efficiently and effectively to the next generation. Sometimes this requires trusts, LLC’s, gifting strategies, etc. These documents help prepare the money for the family. However, sometimes you must prepare the family for the money.

There are families who believe starting a business should be prioritized over formal education. They want to pass on a legacy of entrepreneurship, problem solving and helping others. This is very common when the parents build their wealth from a family business.

Other families may have been great at saving and sacrificing day to day to build a larger net worth. They may want their children to continue sacrificing but have some flexibility with other options in life they didn’t have access to during their lifetime.

No matter which way you feel, there are a few ground rules to consider.

- Determine your purpose for your wealth

- Share the vision with your family and professionals.

- Discuss Philanthropy and how it could be beneficial for the charities you support, as well as tax strategies that can be used to increase your gifting.

- Identify Estate Planning vehicles that can assist with your vision.

- Hold Family Meetings to revisit your goals as well as the children’s

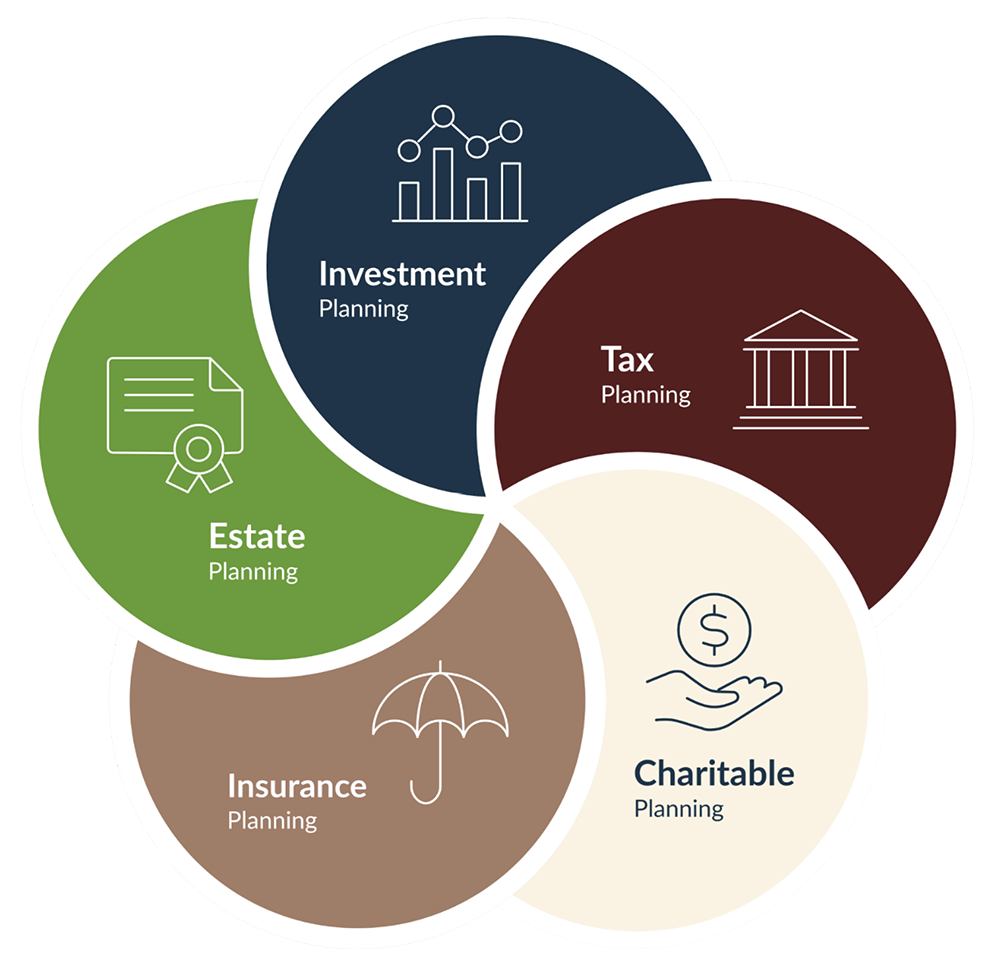

When it comes to pulling this off, its important that you have a Team of Professionals who work in your best interests to educate, advise, and can serve as a sounding board. Below are five areas that should be managed simultaneously when creating, managing, and passing along a client’s Generational Wealth.

Managing these areas effectively allows you to preserve and grow the wealth that will be passed down to the next generation. Managing the discussion with children around your philosophical viewpoints on wealth allows that wealth to perpetuate from generation to generation, creating a legacy.

If you are interested in learning more about how to build, preserve and pass along your Generational Wealth, please contact us at [email protected]

Cleveland Wealth, LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.